-

With stars shining over the vast plains and the ship sailing into the great river, CR, forging forward for 87 years, is accelerating its journey to build a world-class state-owned capital investment company, navigating challenges and advancing resolutely.

We understand that a grand journey filled with challenges ahead requires strong leadership to steer the course. A robust corporate governance system and strong governance effectiveness are essential to ensure the correct direction of corporate development. Over the years, CR has consistently fulfilled its economic responsibilities at a high level, achieving breakthroughs in value creation, performance and shareholder returns. This is a vivid practice and fruitful outcome of effective governance leading the way.

>The eighth training session for senior management of the Group was held in conjunction with the second learning session of the special study class on studying and implementing the spirit of the Third Plenary Session of the 20th CPC Central Committee. The aim is to deepen their understanding of General Secretary Xi Jinping's important philosophy of pooling talents in the new era, and provide them with thorough learning on deploying important decisions from the plenary session regarding the reform of the talent development system and mechanism. Centered on the overarching work of "dual core and one force", we strategically planned and advanced talent work and the construction of talent hubs by deepening "four restructurings" to support and ensure the implementation of the "1246" model. Top-level Design

Comprehensive strategic planning leads to success. We have contributed the wisdom of CR to the top-level design for laying the solid foundation and strengthening the pillars of corporate governance.

After summarizing and organizing our approach, we have established four fundamental governance principles: strategic leadership, systematic advancement, legal compliance, and market orientation. In general, we focus on the strategies of building a state-owned capital investment company and a world-class enterprise through the development of our governance system. Specifically, we integrate the construction of the board of directors, organizational management, and system development to ensure that board decisions are effectively communicated through organizational management and implemented through appropriate systems. During this process, we focus on internalizing external laws, promoting co-governance, and selecting the best practices. In terms of implementation, we prioritize policies and systems that are closely aligned with our businesses and services, ensuring they are practical, effective, and user-friendly.

Through measures such as optimizing the governance structure, establishing a three-tier management structure, and implementing differentiated management of business units, CR has established a governance model based on capital, which has significantly improved its governance capability and level.

In December 2023, the White Paper on Corporate Governance of CR was released to the public, fully disclosing our corporate governance framework, governance entities, decision-making mechanism, supervision mechanism, information disclosure mechanism, sustainability system, management structure, and related management systems. This is the world’s first corporate governance white paper proactively disclosed by an enterprise, through which we make a solemn commitment to the public and stakeholders, opening a new chapter in CR’s corporate governance.

Structure and Essence

Structure aligns with essence. In terms of advancing corporate governance from mere structural improvement to a holistic approach that emphasizes value creation, we have accumulated CR’s experiences.

At CR, the board of directors serves as the "brain" for setting strategies, making decisions, and managing risks. It holds four regular meetings annually, along with certain ad hoc meetings. Each regular meeting includes strategic topics in specific areas, allowing for collaborative discussions between the board of directors and the management team, which is a key channel for the board of directors to play its role in “strategic decision-making”. Through in-depth strategic research on topics such as the semiconductor business, technological innovation, Hong Kong operations, and capital management, the board of directors and management have developed a strong strategic consensus.

How can the board of directors evolve from merely an approval body to a key institution for value creation that drives the reform and development of the Group? At CR, the board members engage in the entire process of strategy formulation, execution, and evaluation. In recent years, for major acquisition projects such as Tasly, KPC and JCET, the board members have conducted in-depth on-site investigation and research, laying a solid foundation for scientific decision-making.

We place great importance on leveraging the role of external directors by engaging in diverse and candid communications with them. External directors are invited to participate in key meetings such as quarterly work meetings, business planning sessions, and senior management training. Our internal information systems are fully accessible to external directors, who are also provided with comprehensive information necessary for their duties. In 2024, the Group dispatched more than 600 management reports, financial statements, and industry research materials to external directors throughout the year, truly achieving “openness, proactiveness, and completeness” in information support. The scope of investigation by external directors covers all business units. The investigation schedule is balanced, including visits to both high-performing star enterprises and those undergoing challenging reform. These specific and meticulous arrangements have ensured that external directors have a comprehensive and accurate understanding of the enterprise's actual situation, laying a solid foundation for rational decision-making by the board of directors.

The organizational management mechanism significantly impacts corporate strategy implementation and operational efficiency. We have established a streamlined and efficient three-tier management structure that aligns with our strategy: Group (by capital) — Business Unit (by asset) — Operating Unit (by operation). We have created a maturity assessment model to implement differentiated management based on the maturity assessment results of each business unit. This approach enables the Group's headquarters to "lead effectively, develop proactively, serve purposefully, and supervise efficiently”, while granting more operational autonomy to those directly engaged in the business. This ensures that we "manage well without being rigid, and empower without being permissive", fundamentally revitalizing CR's operational vitality and innovation momentum.

Being In-depth and Practical

Strategic moves create momentum. In terms of organic synergy between the Group and its subsidiaries and diversified governance tailored to each enterprise, we formulated the CR approach.

Based on the functional positioning, business type, and management and management model of its subsidiaries, CR has tailored its governance model according to subsidiary-specific requirements and implemented hierarchical measures to establish the board of directors. While ensuring risk control, governance procedures are greatly simplified to enhance the effectiveness of corporate governance in subsidiaries.

CR has 21 listed companies in domestic and international markets. The independent director mechanism is an important arrangement for the governance of listed companies. After our systematic review of the policies and requirements regarding independent directors in Mainland China and Hong Kong, we have strictly screened candidates for independent directors, and established a pool of 91 high-caliber candidates, enabling an orderly rotation of the team of independent directors of listed companies.

CR evaluates the performance of external directors in business units annually, based on two components: performance assessment and annual duty evaluation. The performance of the enterprises where external directors serve accounts for 30% of this evaluation, ensuring that they focus not only on risk management but also on performance, thereby genuinely aligning governance with business objectives.

Under the overall governance structure of the Group, each business unit has steadily promoted the process of governance optimization, leading to numerous successful practices.

CR Power is an exemplary model for its subsidiaries to promote the establishment of a professional board of directors. The diversity of the board members provides a wider range of perspectives for decision making, which is a major advantage of CR Power. The four specialized committees, namely, the Audit and Risk Committee, the Remuneration Committee, the Nomination Committee and the Sustainability Committee, provide solid professional support to the board of directors of CR Power in decision making, which significantly enhances the professionalism of the board of directors' operations and effectively reduces decision-related risks.

The board of directors of CR Power has undertaken deep reflections on its long-term development, setting a strategic reform goal to achieve over 50% of its installed capacity from renewable energy by the end of 2025. This goal outlines a clear path for building a world-class clean energy enterprise.

In terms of strategy implementation, the board of directors of CR Power has focused on the long-term perspective by guiding the management to restructure Chongqing Energy and Shengjing Energy, thus creating a model for central-local cooperation. Additionally, the decision to proceed with the equity transfer project of Guizhou Tianrun Coal Mine has effectively addressed long-standing issues related to the disposal of non-core and non-advantageous assets.

CR Double-Crane serves as an excellent example of how subsidiaries can optimize their accountability and responsibility systems while leading industry standards in information disclosure. Activities such as "Understanding Our Listed Companies" and "Shareholders are Welcome" provided engaging and practical opportunities for investors to visit research and development (R&D) labs and production facilities, facilitating in-depth discussions with the management team. As a core component of governance for listed companies, CR Double-Crane has established a multi-dimensional and multi-channel information disclosure and communication system. Through performance releases and joint meetings with securities brokers, the Company gains deep insight into investor demands and provides targeted responses.

CR Double-Crane has also established a "wood" governance structure, systematically organizing responsibilities (horizontally), authority (vertically), systems (slantingly), and procedures (downstroke). This approach integrates horizontal responsibilities and vertical authority, supported by the integration of responsibilities and authority, with four functions collaborating around corporate governance. Sound corporate governance has provided strong momentum for CR Double-Crane. By 2024, the Company surpassed 30 in the number of consistency assessment and applications for generic drugs, with 15 innovative drugs under research and over 10 synthetic biology reserves. Additionally, it has established 11 technical platforms and 10 research institutes, demonstrating significant progress in building new productive capacities for pharmaceutical companies.

CR's exploration and practice in corporate governance have received widespread recognition. CR was selected as the first batch of central state-owned enterprises to demonstrate corporate governance. Its board of directors has been consecutively rated as "Excellent", and the three-tier management model has been recognized as an "Organizational Management Benchmark Model for State-Owned Capital Investment Company". The assessment of subsidiary board composition has been ranked first among central state-owned enterprises for consecutive years.

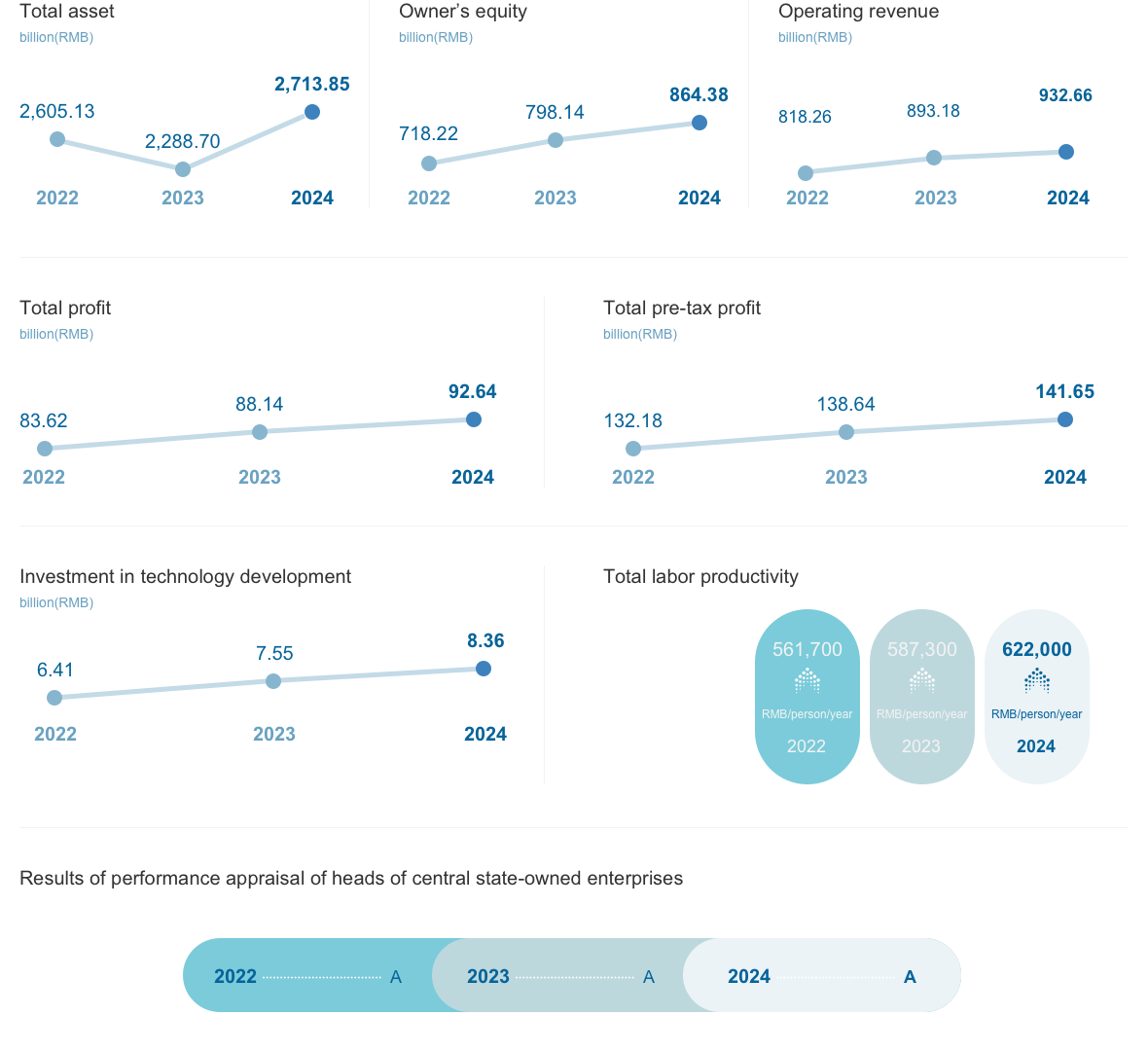

Governance drives efficiency. In recent years, various operating indicators of CR have continued to grow. In 2024, operating revenue and total profit reached RMB 933.5 billion and RMB 92.6 billion respectively, with growth rates consistently exceeding the average among central state-owned enterprises. The Group ranks 72nd in the Fortune Global 500.

The path is smooth as a whetstone, and we advance without stopping. With a broader historical perspective and a wider global vision, we will continue to advance the modernization of corporate governance, contributing the strength of CR to this enduring journey.

-

Our Philosophy